eCommerce growth is expected to continue as the pandemic persists, and merchants are working to support the increasing volume of cross-border transactions. One survey found that 32% of consumers from 40 countries made more cross-border purchases from online retailers in 2020 due to the pandemic and that 51% planned to do more cross-border shopping in the future. The survey also revealed, however, that consumers are not always satisfied with the cross-border eCommerce experience.

One area of dissatisfaction was delivery speed, with 31% of shoppers reporting that their purchases from websites based in other countries took more than 15 days. Another complaint pertained to the customs duty payment process, with which 10% of consumers said they were “dissatisfied” and 3% were “very dissatisfied.”

eCommerce merchants looking to keep cross-border shoppers engaged must find ways to streamline cross-border sales, reduce payment frictions and enable new payment options. Transparent, secure and fast online shopping experiences help retailers build customer loyalty, reduce cart abandonment and increase sales.

The following Deep Dive examines how merchants can improve customer satisfaction and engagement by providing a localized and frictionless cross-border eCommerce environment. It also delves into how supporting a variety of digital payment options can help eTailers earn global consumers’ long-term loyalty through a familiar and trusted shopping experience.

What Consumers Expect From Cross-Border eCommerce

The pandemic has altered consumers’ shopping patterns and views of online spending. eTailers’ chief concern today is how to create a positive customer experience and meet digitally savvy consumers’ high expectations for seamless and safe eCommerce.

A recent report indicated that online shoppers in Australia, Canada, Mexico, the United Kingdom and the United States have specific criteria when deciding which eCommerce sites to use and which to avoid. Cross-border online consumers expect a convenient, streamlined and secure shopping experience regardless of where they are located. The analysis found that 52% of all consumers order from both domestic and international merchants, with 50% most likely to shop on a mobile phone or tablet.

It also revealed that consumers worry about fraud but have little patience with merchants that reject their orders due to a false fraud alert: 39% of consumers reported that they would never shop again with a merchant that declined their order. Although 42% of respondents said they had been victims of online fraud, 78% reported feeling just as safe or safer shopping online than in stores, suggesting a healthy outlook for eCommerce growth.

However, offering a localized online shopping experience is key to being successful in cross-border eCommerce. More than one-third of consumers in another global survey of cross-border shopping habits said being able to shop a site in their local language and local currency contributed the most to their decision to purchase. Transparency also was essential, as one-third of respondents said seeing all charges, taxes and duties clearly displayed was the most important factor in their decision to buy.

The Role of Digital Payment Options in Lessening Online Frictions

Providing customers with their desired payment options is key to a great customer experience anywhere in the world, according to recent data, and digital wallets are becoming a must-have for eCommerce sites. These tools are growing in popularity worldwide, with more than 4.4 billion digital wallet users expected by 2025. Another global study concluded that the ability to use a digital wallet for online purchases could reduce payment frictions by not interrupting a customer’s payment flow, as only 40% of eCommerce shoppers had credit cards within easy reach.

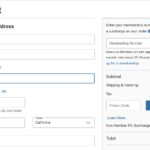

Optimizing the cross-border payment experience includes allowing international shoppers to pay using methods that are popular in their home countries, and supporting the right mix of currencies and payment options is likely to gain importance as global eTailers add more of both. PYMNTS’ research found that the average cross-border eCommerce site supported 10.8 currencies for transactions in 2021, up 77% from the average 6.1 currencies supported in 2016. The average merchant also allowed international shoppers to pay using any of 6.8 payment methods in 2021, up from 5.7 in 2016.

As consumers’ appetite for new, fast and flexible digital experiences continues to grow, global retailers have embraced eCommerce, and the adoption of innovative payment technologies also is on the rise. A recent study conducted across 18 global markets found that 93% of consumers have considered using at least one emerging payment technology in the past year, such as cryptocurrency, biometrics, contactless or QR codes. Nearly two-thirds of respondents reported having tried a new payment method due to the pandemic that they otherwise would not have used.

Simplifying the purchase process also is key to stemming cart abandonment, as up to half of global eCommerce shoppers abandoned carts when the checkout process was too long or complicated. This also means cross-border eTailers must avoid being intrusive or requiring too much information at checkout.

Removing cross-border payments frictions through payment innovation benefits all parties, and tailoring the payment experience to meet consumers’ expectations for seamless and trusted transactions drives engagement and increases sales. Adopting new payment options could present growth opportunities for merchants by helping them meet the rising demand for cross-border eCommerce.