New research finds that 91% of consumers believe a good checkout experience is decisive in whether they will — or won’t — shop, and continue to shop, on eCommerce sites.

As such, the checkout experience is something that merchants must improve, or risk the consequences of more abandoned carts at a time when every conversion counts. Checkout.com executive Akin Kayim told PYMNTS this revolves around shortening the steps required, putting calls to action where they don’t interrupt the flow and ensuring transactions are successfully authorized.

Doing so involves a few core steps that, taken together, can have an immense impact on outcomes. Many are digital best practices that are easily handled in platform environments.

“It can vary from the placement of form fills to colors on the CTA buttons,” he said. “Having a well-considered design makes this process frictionless and promotes stickiness to encourage the shopper to not only complete, but also come back to the website and have that loyalty.”

Discussing findings from the study “Building A Better Online Checkout Experience: The Key Features That Matter To Customers,” a PYMNTS and Checkout.com survey of 2,030 U.S. consumers, Kayim noted that to make loyal customers out of bargain hunters, it takes trust.

Nurturing it is a multifaceted job, however, taking in factors from checkout page design to payments glitches like false declines to effortless returns.

Get the study: Building A Better Online Checkout Experience: The Key Features That Matter To Customers

Optimizing for Omnichannel

The study found that social media sites are among the most friction-filled, with shoppers reporting at least one pain point in 60% of their most recent transactions. For retailers, that’s especially problematic, given how important the social channel is to shoppers — and how social sign-in and a consistent checkout across devices moves the sales needle.

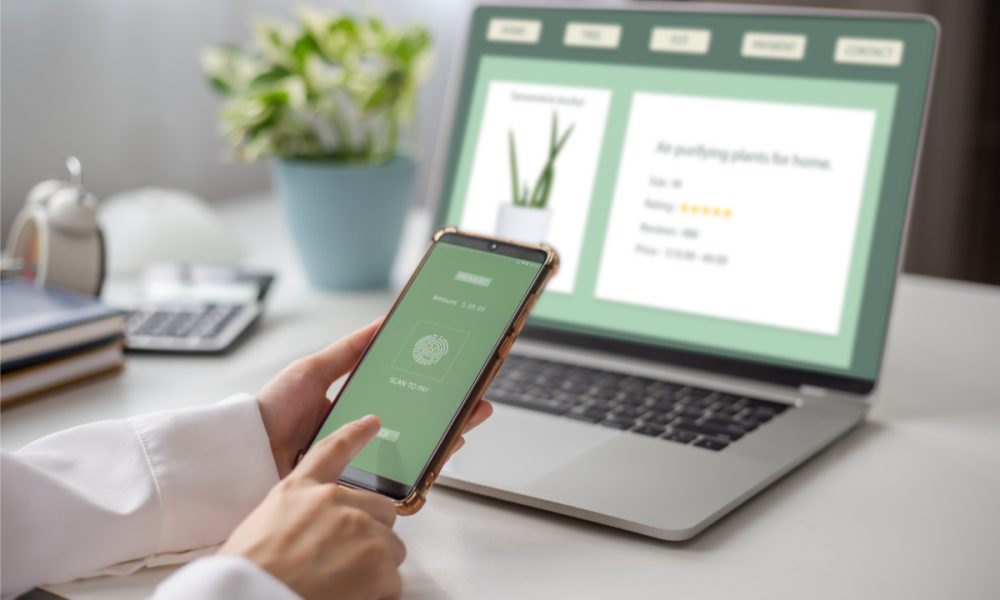

“How people shop is changing, and mobile commerce is becoming increasingly favored,” Kayim said. “So, merchants need to place significant focus on ensuring the payment journey is optimized and consistent across all these different devices.”

With 94% of consumers citing social sign-in as one of the most desired checkout features, it’s platforms like Checkout.com that are helping merchants understand the ways to achieve these goals “without putting barriers up within the checkout process.”

He added that A/B testing is a great way to learn more about your customer’s needs and to understand what works and what doesn’t — like asking shoppers to create accounts or provide extra information to complete their purchase. It explains a lot of abandoned carts.

Sharing a personal story from the depths of the pandemic, Kayim explained how he was unable to find contact lenses, ordered them online and, after he paid, the site asked if he wanted to save his info.

He did. That’s where he gets his contacts now. “We know how many contacts you ordered, so we’ll send a reminder when to reorder. Perfect. All I needed was to provide a password. I’ve already provided my details. Now every time I get my reminder, it’s two clicks — I click on the email, it takes me to the cart, confirm, pay, finish. It’s that simple.”

Kayim said that in all of this, “The most important thing is to test and validate. Any assumptions are hypotheses that you have because consumers and their behaviors are changing all the time. So, A/B testing is a great way to learn more about your customer’s needs and to understand what works and what doesn’t.”

See also: Friction-Free Checkout Can Turn Deal-Chasers Into Loyal Customers

Ending Awkward Card Declines

Another avoidable checkout faux pas is the false decline. That’s an area where trust enters the frame again and requires special consideration.

“Customers are telling us is that they’re not willing to accept false declines,” he said, adding that “44% say that they’d give up on the purchase if they experience a false decline.”

Tools like account updaters help in these cases, so “instead of having that awkward false decline where the card’s expired, you can automatically retrieve those new details rather than asking your customers to now enter their new card information.”

For declines due to expired card details, there are simple steps merchants can take, such as the aforementioned account updaters, that automatically update a consumer’s card details held on file. Then there are more complex workstreams, such as building the ideal risk strategy that strikes that balance between performance and protection.

The Checkout.com platform also has its own robust fraud defenses that assign risk scores, but merchants can use whatever they’re comfortable with, provided it keeps the checkout smooth.

Whereas anti-fraud is sometimes labeled a checkout friction, Kayim disagreed, saying, “These tools enable merchants and businesses in digital commerce. Fraud filters can be used to flag suspicious transactions, which can then be manually reviewed to ensure an accurate decisioning. The most important thing is to understand the trends.”

New PYMNTS Study: How Consumers Use Digital Banks

A PYMNTS survey of 2,124 US consumers shows that while two-thirds of consumers have used FinTechs for some aspect of banking services, just 9.3% call them their primary bank.

https://www.pymnts.com/healthcare-financing/2022/consumers-willing-to-shop-around-for-a-doctor-that-offers-patient-plans/partial/